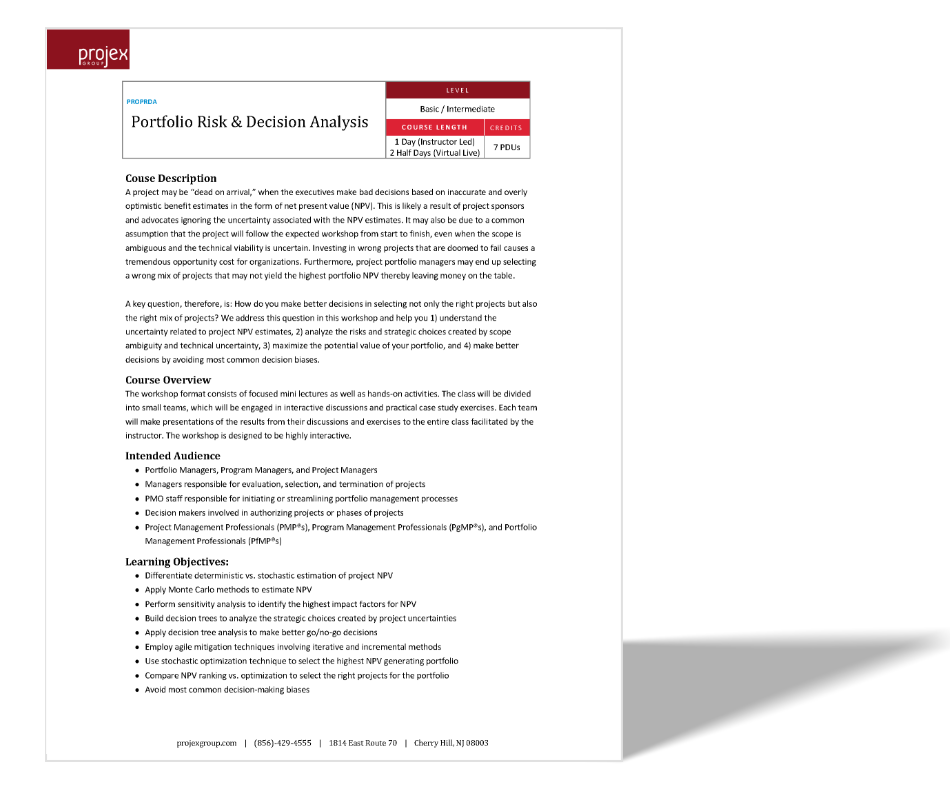

PROPRDA

Portfolio Risk & Decision Analysis

LEVEL

Basic / Intermediate

COURSE LENGTH

1 Days (Instructor Led)

2 Half Days (Virtual Live)

CREDITS

7 PDUs

Course Description

A project may be “dead on arrival,” when the executives make bad decisions based on inaccurate and overly optimistic benefit estimates in the form of net present value (NPV). This is likely a result of project sponsors and advocates ignoring the uncertainty associated with the NPV estimates. It may also be due to a common assumption that the project will follow the expected workshop from start to finish, even when the scope is ambiguous and the technical viability is uncertain. Investing in wrong projects that are doomed to fail causes a tremendous opportunity cost for organizations. Furthermore, project portfolio managers may end up selecting a wrong mix of projects that may not yield the highest portfolio NPV thereby leaving money on the table.

A key question, therefore, is: How do you make better decisions in selecting not only the right projects but also the right mix of projects? We address this question in this workshop and help you 1) understand the uncertainty related to project NPV estimates, 2) analyze the risks and strategic choices created by scope ambiguity and technical uncertainty, 3) maximize the potential value of your portfolio, and 4) make better decisions by avoiding most common decision biases.

Learning Objectives:

Differentiate deterministic vs. stochastic estimation of project NPV

Apply Monte Carlo methods to estimate NPV

Perform sensitivity analysis to identify the highest impact factors for NPV

Build decision trees to analyze the strategic choices created by project uncertainties

Apply decision tree analysis to make better go/no-go decisions

Employ agile mitigation techniques involving iterative and incremental methods

Use stochastic optimization technique to select the highest NPV generating portfolio

Compare NPV ranking vs. optimization to select the right projects for the portfolio

Avoid most common decision-making biases